TARGET DATE FUNDS

Take the guess work out of investing for retirement

Geneva’s Target Date Funds remove the challenges of investing for retirement, so you can focus on making contributions. Geneva will handle the work of investing by selecting an appropriate mix of investments based on your projected date of retirement, adapting the investment mix to make it more conservative as you approach retirement.

Benefits

• Simplify investing without compromising on quality – your account is invested in a diversified portfolio and adapted based on your age

• Trust that your values are reflected in your retirement investments – our Biblical Values Investing Committee continuously implements a rigorous screening process to ensure our investments aligns with our convictions and values

• Receive special tax benefits as a pastor or ministry staff including higher contribution limits through our 403(b)(9) retirement plans, housing allowances for pastors, 100% vesting from the first dollar contributed, and more

• Invest at low costs – our professionally managed Target Date Funds are affordable due to no commission, sales, or transfer fees to manage or change investments

• Access to a team of retirement readiness and financial wellness professionals at no cost to you

• Rollover options are available

Who Can Participate?

Ministers, church ministry staff, and church school staff who work for a PCA church, an ARPC church, or a pre-approved like-minded organization may be eligible to participate.

Employees working for pre-approved 501(c)(3) organizations that share common religious bonds and convictions with the PCA may also qualify. To determine how to become an approved organization, contact our office.

Tax Advantages

Housing Allowance

Ministers who participate in our 403(b)(9) retirement plans may be eligible for a housing allowance income exclusion during retirement. This provision may provide significant tax savings to you during your retirement years.

For example, a minister in the 22% tax bracket with $20,000 of annual housing allowance would save $102,414.27* in income tax over a 15-year retirement—and the tax savings would increase for ministers in a higher tax bracket or with a larger housing allowance.

*When tax savings are invested returns are not guaranteed, calculated at a 6% rate of return.

Pre-tax vs. Roth Employee Contributions

Our retirement plans provide you with the choice of making pre-tax employee contributions, or Roth employee contributions. You also may divide your contributions between the two types. Each offers valuable tax advantages, and you should consult with your personal financial advisor or a member of our team to determine which is best for you.

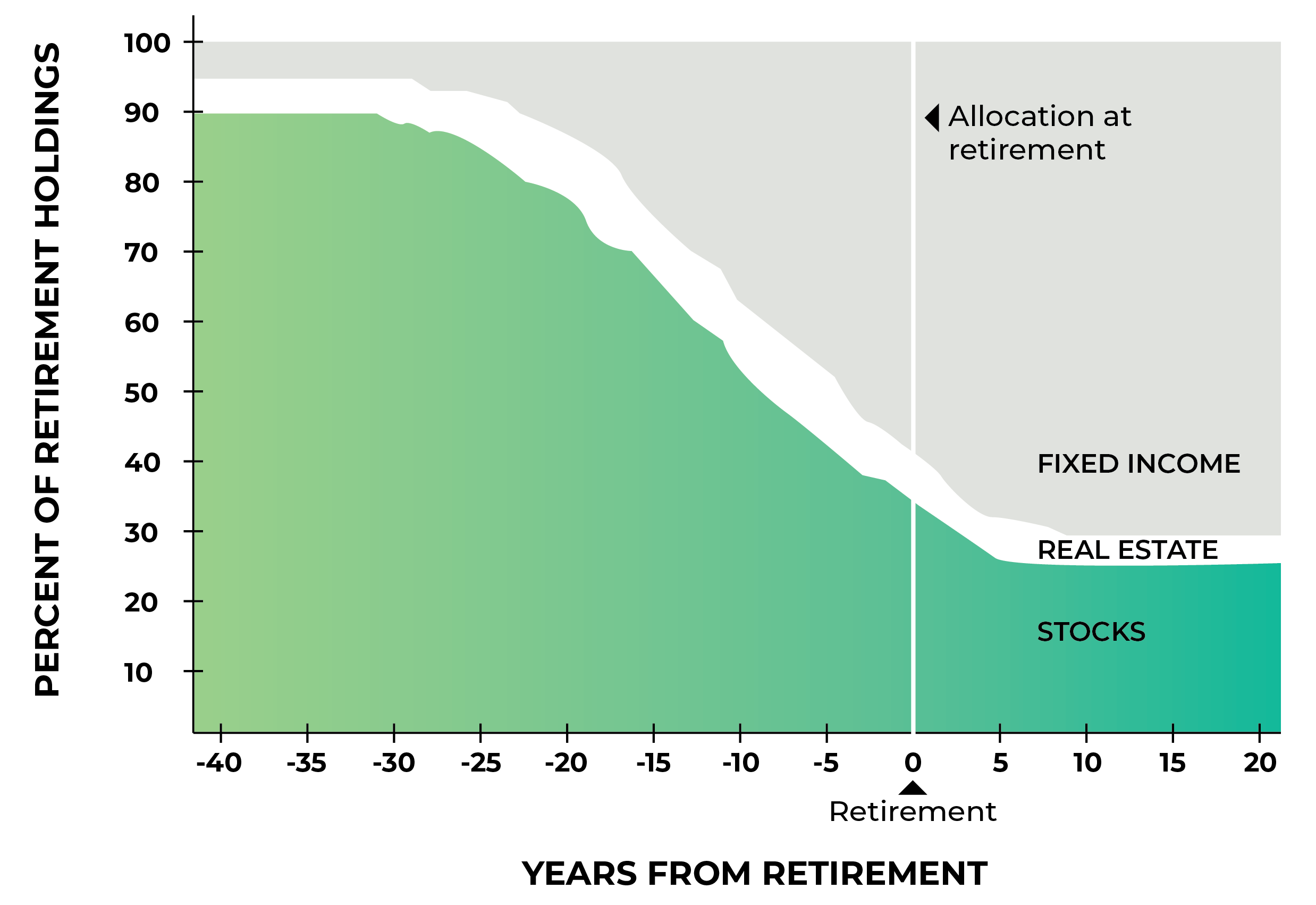

Investment Risk Calculation Approaching and After Retirement

The above chart shows the percentage of investments within a Target Date Fund along a timeline of years before (-) and after (+) retirement. You will note as an investor approaches retirement his/her allocation of stock investments (equities) will gradually decrease and be replaced with more conservative investments such as bonds (fixed income). This is a very important process which automatically happens and incrementally reduces the risk associated with your Target Date Fund.

Get Started

Schedule a free consultation about retirement readiness or financial wellness

FAQ

How are my retirement contributions invested?

You are automatically invested in an age-appropriate target-date fund. This is a diversified mix of investments that become more conservative as you near retirement. In addition, other more “DIY” options are available for the more experienced investor.

What kind of retirement account do you offer?

We offer a 403(b)(9) retirement plan. Typically, a 401(k) is used in the for profit world, while a 403(b) is used in the non-profit world. Our retirement plan is a 403(b)(9) with special features for denominations and churches. One of the key features is housing allowance in retirement for ministers which provides a tremendous tax savings.

How much should I be saving for retirement?

It really depends. The earlier you start, the more time your money has to grow. But, it’s never too late to start saving! Our retirement readiness team would love to help you construct a plan to reach your goals.

How much does it cost to meet with a financial planner?

Nothing. Geneva knows the complexities associated with planning for retirement. Meeting with one of our Retirement Readiness Planners to discuss your unique situation has no additional cost to you or your church/organization. Set up a meeting today.